tax abatement nyc meaning

Ad End Your IRS Tax Problems. The 421-a abatement was initially set to run for 10 years but can run for as long as 15-25 years in upper Manhattan and the outer NYC boroughs.

How Much Is The Coop Condo Tax Abatement In Nyc

Of course in practice its a little more complicated than that.

. The end of the 421a housing-construction abatement means that the states property tax laws must be reformed. Once approved you must complete. The exemption also applies to.

A residential tax abatement program is a reduction of a real property tax bill imposed on specific properties by a local government like New York City. The tax benefit comes from the average value of whats inside the building. The 421a tax abatement is a tax bill granted to property developers and focuses on affordable housing in densely populated areas of New York.

How Much Is The Coop Condo Tax Abatement In Nyc 10 minute walk to EF train station Kew Gardens. The 421a tax abatement on a property ranges from 10 to 25 years depending on which specific code it falls under. Put simply a tax abatement is exactly what it sounds like.

Codes 5110 and 5117 offer a 10 year term. Abatements reduce your taxes after theyve been calculated by applying dollar credits to the amount of taxes owed. BBB Accredited A Rating - Free Consult.

Typically the goal of. A break on a building or apartments property taxes. Ad End Your IRS Tax Problems.

May 30 2022 622pm. Finance administers the benefit. A co-op tax abatement assessment is authorized by the Board of Managers also known as the co-op board.

In NYC 421-a tax abatements were introduced in 1971 and were implemented to encourage developers to develop unused and underutilized land by offering them reduced. The higher the property value the lower the tax benefit from New York City. The amount and duration of the reduction is determined by a bunch of factors but generally the benefit lasts 10.

BBB Accredited A Rating - Free Consult. A tax abatement is a reduction of the property taxes in a building. Tax Abatement in California.

Co-Op and condo unit owners may be eligible for a property tax abatement. The NYC Department of Housing Preservation and Development HPD determines eligibility for this program. Homeowners can receive a 7000 exemption on their propertys assessed value for their main home if they reside in it on January 1.

Co-op and condo boards and managing agents must notify the Department of Finance of changes in ownership or eligibility for the Cooperative and Condominium Property Tax Abatement by. If a co-op chooses to levy an assessment shareholders will receive. A tax abatement is a property tax incentive government entities issue that will reduce or eliminate taxes on real estate in a specific area.

Tax abatement nyc meaning Thursday March 10 2022 Edit. What Is a Tax Abatement.

Tax Abatement Nyc Guide 421a J 51 And More

Nyc 421a Tax Abatements What Are They And How To Verify Yoreevo Yoreevo

4 Ny Solar Incentives For Homeowners Brooklyn Solarworks

What Is A Tax Abatement Should You Buy A Home With One Localize

What Is A 421a Tax Abatement In Nyc Streeteasy

Nyc 421a Tax Abatements What Are They And How To Verify Yoreevo Yoreevo

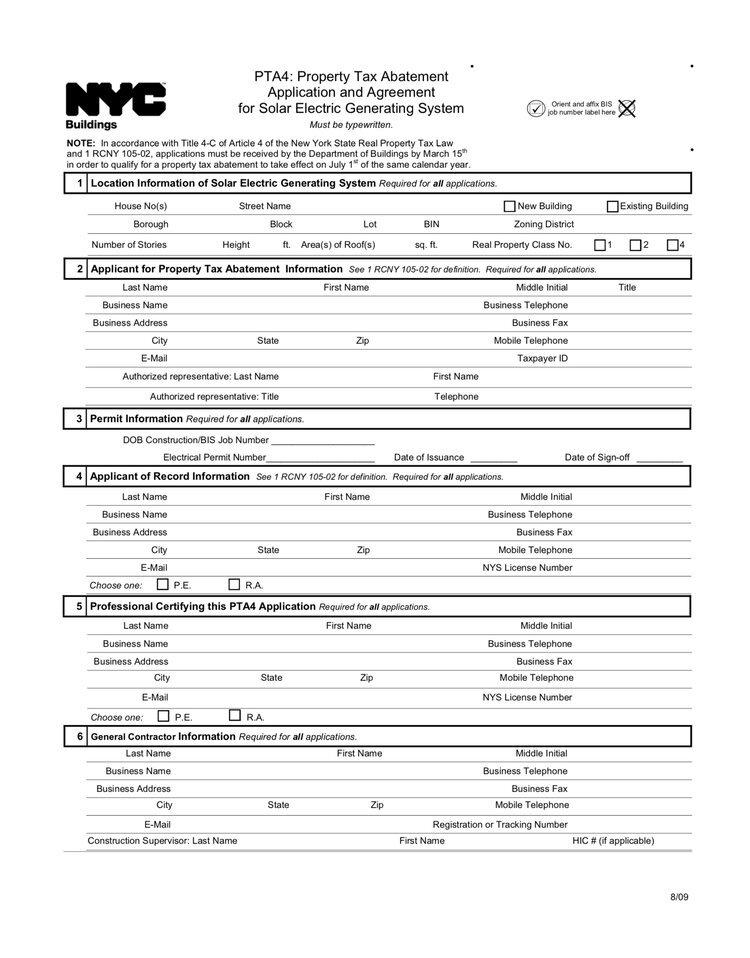

Nyc Solar Property Tax Abatement Pta4 Explained 2022

4 Ny Solar Incentives For Homeowners Brooklyn Solarworks

How Much Is The Coop Condo Tax Abatement In Nyc

What Is The 421g Tax Abatement In Nyc Hauseit

How To Calculate The Unabated Property Taxes On A Nyc Condo With A 421a Tax Abatement Youtube

Nyc 421a Tax Abatements What Are They And How To Verify Yoreevo Yoreevo

Nyc 421a Tax Abatements What Are They And How To Verify Yoreevo Yoreevo

Apartment Project Tax Break 421a Is Gone Maybe For Good

What Is The 421a Tax Abatement In Nyc Youtube

Nyc 421a Tax Abatements What Are They And How To Verify Yoreevo Yoreevo

What Is The 421g Tax Abatement In Nyc Hauseit

Nyc 421a Tax Abatements What Are They And How To Verify Yoreevo Yoreevo